Recording the payment prevents you from spending the money twice-the funds will still show as available in your account until after the check is deposited or cashed, and that could take a while. A check register is an ideal place to do this, whether you use an electronic or paper register. Justin PritchardĪfter you write the check, make a record of the payment. Calculate your running balance so you know how much money you have right now. Copy everything from your check so you know what happened later. Make a note of the transaction in your check register. For example, you could write your Social Security Number on this line when paying the IRS, or an account number for utility payments.

It might also be the place to write information that your payee will use to process your payment (or find your account if anything gets misplaced). The memo line is a good place to add a reminder about why you wrote the check. This step is optional and will not affect how banks process your check.

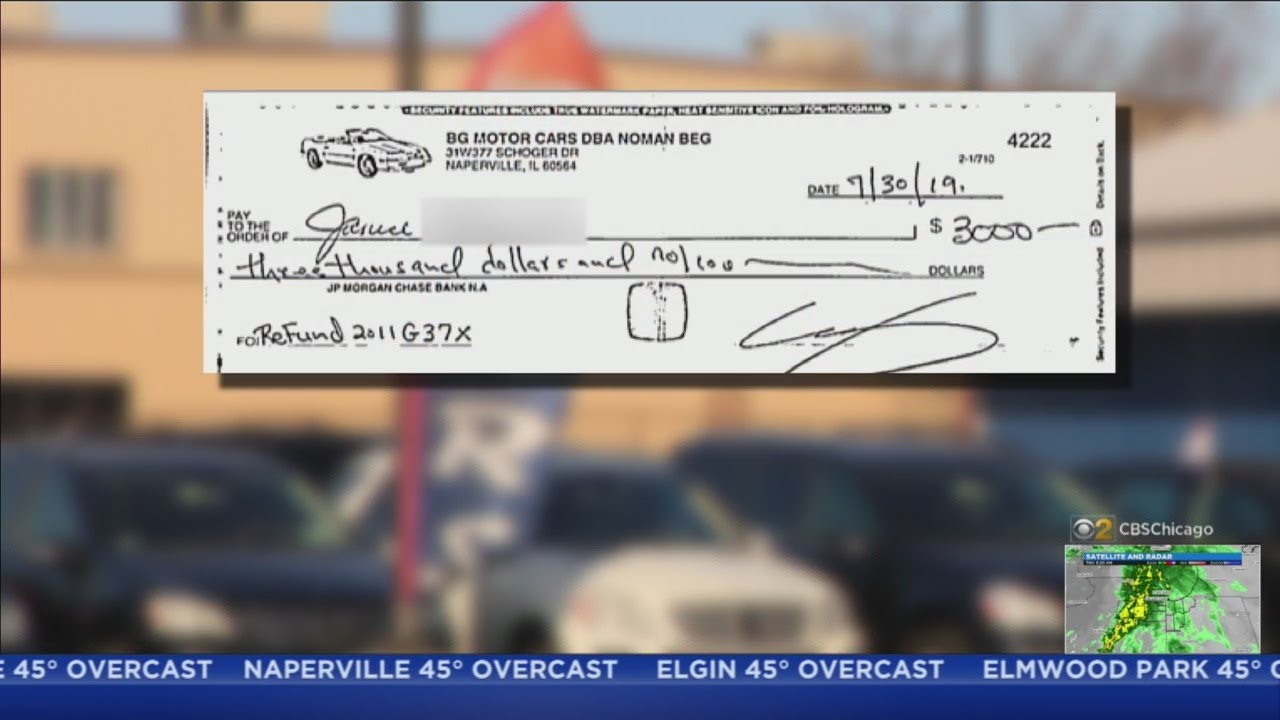

Memo (or “For”) line: If you like, include a note. This step is essential-a check will not be valid without a signature. Use the same name and signature on file at your bank. Signature: Sign the check legibly on the line in the bottom-right corner. Use all capital letters, which are harder to alter. If that amount is different from the numeric form that you entered in the previous step, the amount you wrote with words will legally be the amount of your check. This will be the official amount of your payment. Amount in words: Write out the amount using words to avoid fraud and confusion.

Memo (or “For”) line: If you like, include a note. This step is essential-a check will not be valid without a signature. Use the same name and signature on file at your bank. Signature: Sign the check legibly on the line in the bottom-right corner. Use all capital letters, which are harder to alter. If that amount is different from the numeric form that you entered in the previous step, the amount you wrote with words will legally be the amount of your check. This will be the official amount of your payment. Amount in words: Write out the amount using words to avoid fraud and confusion. #Chase checkbook covers how to

See examples of how to write in the amount. If your payment is for $8.15, the "8" should be right up against the left-hand border of the dollar box to prevent fraud. Start writing as far over to the left as possible.

Amount in numeric form: Write the amount of your payment in the small box on the right-hand side. You may have to ask "Whom do I make the check out to?" if you're not sure what to write, because this information needs to be accurate. Payee: On the line that says "Pay to the order of," write the name of the person or organization you’re paying. You can also postdate the check, but that doesn't always work the way you think it will. In most cases, you’ll use today’s date, which helps you and the recipient keep accurate records. Current date: Write this near the top right-hand corner. Use this as an example or move through the steps below ( View larger). If you don't, your payments may " bounce" and create problems, including hefty fees and potential legal issues.Ī completed check. No matter how you choose to pay, make sure you always have sufficient funds available in your checking account. Just be sure that you've always got enough cash in your account to cover the bill. There's typically no charge to pay this way, and it makes your life easy. Set up automatic payments for regular payments like utility bills and insurance premiums. There’s no need to use up checks (which you'll have to re-order), and you'll have an electronic record of your transaction with the payee name, the date of your payment, and the amount. You'll pay out of the same account, but you'll do it electronically. Get a debit card and spend with that instead. You won't need to write the check, pay for postage, or get the check in the mail

Pay bills online, and even tell your bank to send a check automatically each month.You might have other options that would make your life easier and help you save money. Writing a check is cumbersome, and it’s not the fastest way to move money. Before writing a check, make sure that it’s really something you need to do.

0 kommentar(er)

0 kommentar(er)